In this article, we will cover 3 different approaches to profiting from buying and selling sports cards (also known as flipping) and analyze the pros and cons of each approach.

(Disclaimer: This article simply covers approaches and makes no guarantees on profits. Do your own research and buy at your own risk. Also, read this if you are new to collecting and investing in sports cards.)

The real challenge for flippers and investors is to utilize comparison metrics and recent sales data to make projections.

There are three main approaches to buying low and selling for higher later:

- Player Prospecting (undervalued young players)

- Buy and Hold (short-term investing)

- Buy and Grade (adding value)

The Player Prospecting Approach

Major Pro: Potentially the highest yield

Major Con: Highly volatile and unpredictable

The most common approach I see new investors make is to project the success of a young player, hoping the player’s on-the-court success will translate into a profit.

This approach to flipping is highly volatile.

First, there are so many factors outside a players talent level which can negatively affect their success.

Injuries, bad team market, bad team fit, dull personality, off-the-court issues etc., can all effect a player’s career.

However, in the short term, this can be an effective approach if you were to buy a player’s cards right before they step into a starting role, for example.

You can even profit from the hype before a player has played any games, because when enough of the market demands the card a top prospect, prices will rise in accordance. (ex: Zion Williamson)

In general, the “player prospecting” approach is unreliable and inconsistent. Those who have success can’t really point to any predictive, repeatable metrics to continually reproduce consistent results.

However, if you took a statistical probability risk-management type approach, there may be ways in which the math actually works out.

For example, let’s say you buy 10 prospects and have statistical reasoning to suggest 1 out of the 10 players’ rookie card values will sell for 20x it’s current price at some point in the future. (This is entirely theoretical.)

This may be a profitable scenario mathematically, but I would find it very difficult to believe there is enough data to support these types of scenarios consistently.

In addition, you would need a large sum of capital to mitigate the risk, so this is definitely not a good approach for those who are hobbyists.

At the end of the day, player projecting is all speculation. Even major sports teams with scouts and data analysts who are on salary to help teams make good player investments get things wrong.

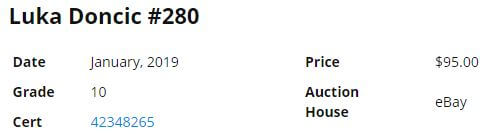

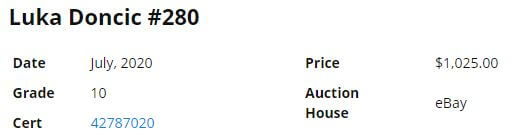

For every flipper or investor who beats their chest because of their Luka Doncic profits, there are hundreds of silent Jimmer Fredette, Miles Turner, Andrew Wiggins, Michael-Carter Williams hot takes that went wrong.

This is not to detract from any of these players or their hard work and accomplishments in the sport, it is just a simple fact that their cards are not very high in demand, and therefore they would not have made for very good economic results if you invested heavily in any of them.

(Although one could argue in the current card market, just about everything has gone up in 2020.)

The Buy and Hold Approach

Major Pro: Stability and Consistency

Major Con: Potentially Lowest Yield from initial investment

Another approach to investing and flipping is the buy and hold approach of already graded cards.

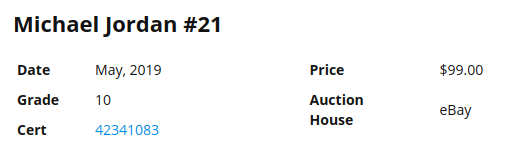

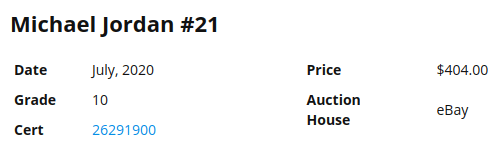

If you buy a 1989 Fleer Michael Jordan PSA 10 card today at a reasonable market price based on eBay recent sales data, chances are that card will increase in value over time.

(Note: this is an exceptional price jump in just one year.)

This is definitely a more sound approach than player prospecting because you can invest in hall-of-fame players who have established careers in the record books.

This approach is similar to those who buy into blue chip stocks and index funds with the intention of holding onto the asset for the long term.

I’m sure there were plenty of investors and flippers who were happy to part ways with some of their Michael Jordan cards after the spike in prices from The Last Dance documentary in combination with an overall burst in the card market.

If they acquired a lot of these assets in 2018, they could have seen yields in the 5x-25x range or more.

However, even if these market factors had not come into play, the value of an iconic, hall-of-fame player like Michael Jordan will generally rise over time.

The reason is simple. As time goes on, the supply in the market shrinks, and a natural rise in inflation with stable demand creates a rise in value.

While this approach is not as high yielding as prospecting can be, it’s the safer, more consistent approach and perfect for someone who wants to collect and display their cards, without spending countless hours of research online.

The Card Grading and Selling Approach

Major Pro: Most Consistent Upside

Major Con: Requires Grading Experience, Market Knowledge, Capital

A raw, ungraded 1989 Fleer Michael Jordan can be found all over eBay for far less than a PSA 9 graded of the same card.

Therefore, it stands to reason that buying a raw ungraded card, getting it graded, and selling it for profit is an approach to bringing value to the card market.

The real key to this approach is gaining experience in either buying raw, ungraded cards and being able to approximate their grade, or being able to do some math on a hobby or retail box and determine if the investment will pay off after you send some of the cards in for grading.

I prefer this method over the others because grading a card immediately raises its value, as long as there is some demand for it in the marketplace.

The biggest downside to this approach is the time commitment. Time for doing research, time to gain the experience required in evaluating a card for grading, and in some cases, the turnaround time for getting the cards themselves graded.

Let’s talk about the research you need to do.

Population Report Research

First, you need to get some sales history data from the grader. PSA makes this pretty easy with their pop reports.

Next, you need to take a look at what percentage distribution of the cards that have been submitted for grading are getting.

For example, if there are 100 cards graded in the population reports, but only 10 (10%) have received a Gem Mint 10 grade, you can assume it is going to be very difficult if not impossible to buy a raw, ungraded card and send it in to receive a 10.

In most cases, you should err on the side of caution. If you assume you are going to get mostly 9s on cards you send in raw (after inspecting them carefully for centering, corners, edges and surface), then you can do some conservative projections to determine what kind of profit you can make.

The reality is that even brand new, out-of-the-pack cards are not guaranteed to be Gem Mint 10s. Off-center cuts and minor ink errors on a card can immediately demote it to a 9 or even an 8.

Some print runs are better than others. It’s just how things work out.

Older cards from hobby boxes are also notorious for sticking together, causing surface issues. This, along with boxes being handled over the years potentially causing minor dings to the corners, will immediately lower the overall grades of the cards in those boxes.

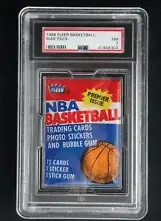

This is why very old packs themselves are sometimes authenticated and graded, especially on high-priced old packs of cards, such as 1986 Fleer basketball.

After you weigh all these grading factors into consideration, you can do some simple spreadsheet math to see how much you could profit by grading a card.

Recent eBay Sales Data Research

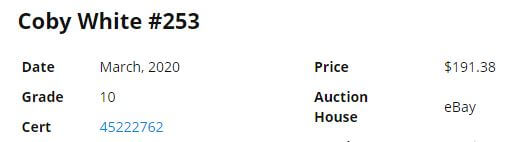

If you see a very sharp, raw card with good images on eBay selling for $10, and recent PSA 9 sales have averaged between $40-$50, this card may have potential.

It will cost roughly $10 to get your card graded (based on bulk service PSA pricing of cards made before 2017), and there will also be shipping costs and selling fees to consider. Overall, you may have to spend around $15 combined.

However, if the card ends up selling for $50, you have just profited $25 on a $25 investment for a 100% ROI.

Based on math I have done and other comps I’ve seen around the internet, it’s very reasonable to consistently turn a 20%-80% profit or more by getting cards graded.

This is assuming you are properly:

- assessing the grades of cards

- there is no significant dip in prices from the time you send your cards in to get graded until the time you sell it.

The biggest downside to the grading and flipping approach is the capital required to buy the cards and grading fees.

Budgeting for grading and selling cards

I would estimate you need approximately $500-$1000 just to get started.

A PSA Platinum membership of $250 will get you 15 graded cards, and access to bulk submission of 50+ cards ($10 per card) and 100+ cards ($9 per card), as long as the estimated value of each individual card is below $499 after grading.

If you start with just the 15 card submission, you also need the capital to buy the cards themselves. If they average around $20, that’s an extra $300 for a total investment of $550.

Now, toss in shipping costs and you are probably around $600 invested.

Once you receive your graded cards, if you can average $75 per sale – you now have $1125 in sales.

Subtract the eBay selling fees and you will probably end up with around $400 in net profit when everything is said and done for an ROI of around 66%.

Just keep in mind it can take a while for all this to take place because grading is a tedious process and the card industry is booming in 2020.

But the more capital and experience you acquire, the more lucrative this can be.

Conclusion

There are many approaches to profiting from basketball cards, including different variations on flipping cards.

Which ever approach you decide to take, make sure you mitigate risk, be picky about what you purchase, and let go of the idea of getting rich.

You can certainly profit from the hobby and enjoy it at the same time.